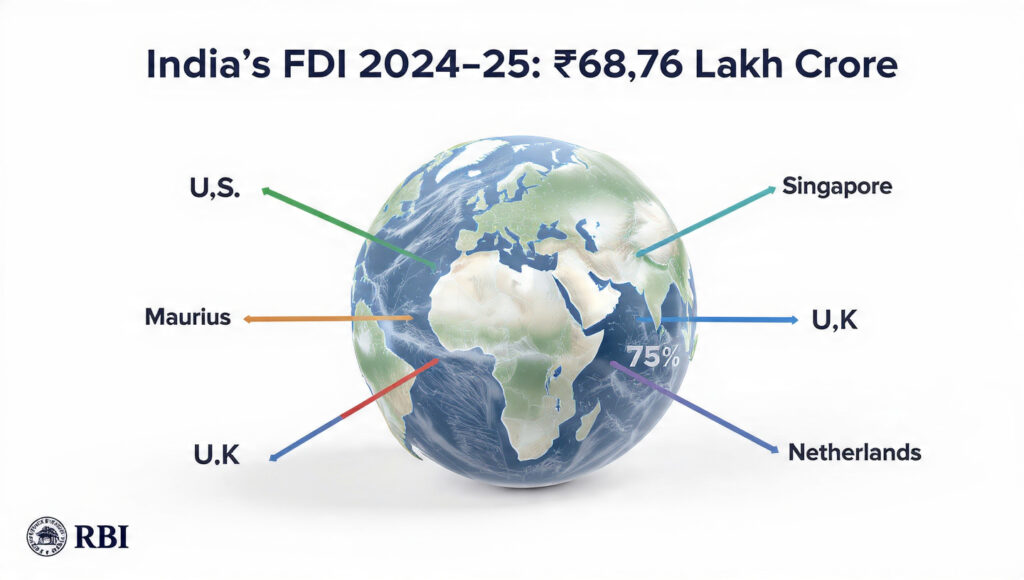

India’s FDI Surges to ₹68.76 Lakh Crore — U.S. and Singapore Lead, RBI FLA 2024–25 Finds

The Reserve Bank of India (RBI) has published the 2024–25 Foreign Liabilities and Assets (FLA) Census on October 29, 2025, revealing a notable rise in India’s cross-border financial engagement.

Among 45,702 surveyed entities, a significant 41,517 firms reported Foreign Direct Investment (FDI) and Overseas Direct Investment (ODI) in their March 2025 balance sheets, signaling a deepening integration of Indian businesses with global capital markets.

The United States and Singapore together accounted for over one-third of India’s total FDI inflows. Other key investors included Mauritius, the United Kingdom, and the Netherlands.

FDI inflows climbed to ₹68.76 lakh crore, a marked increase from ₹61.88 lakh crore in 2023–24, underscoring strong global confidence in India’s economic resilience.

Country-wise FDI Share:

- 🇺🇸 United States: 20%

- 🇸🇬 Singapore: 14.3%

- 🇲🇺 Mauritius: 13.3%

- 🇬🇧 United Kingdom: 11.2%

- 🇳🇱 Netherlands: 9%

The RBI highlighted that this trend aligns with India’s growing appeal as a resilient investment hub, driven by economic stability, digital reforms, and global investor trust.