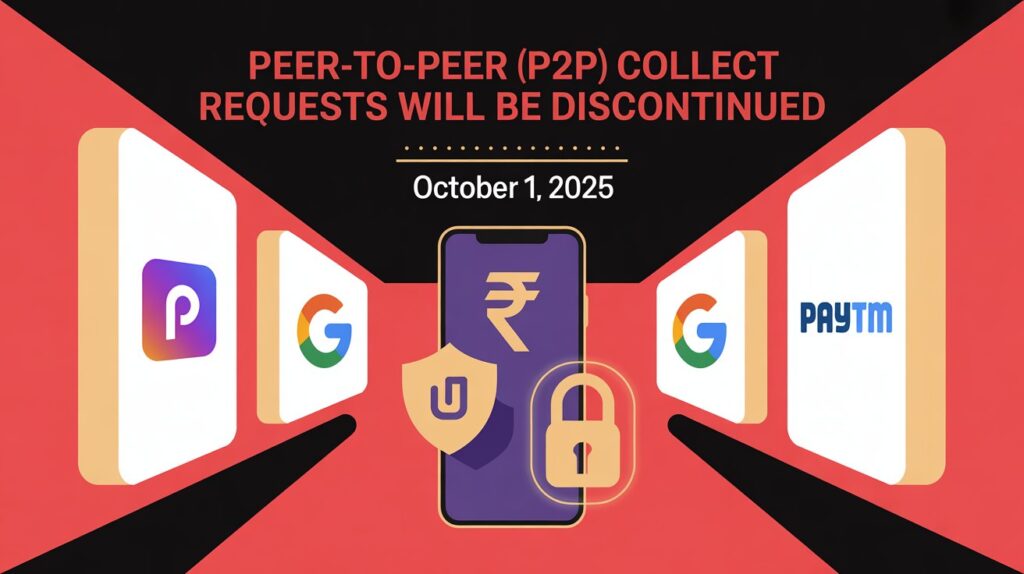

The National Payments Corporation of India (NPCI) has announced a significant update for Unified Payments Interface (UPI) users.

Starting October 1, 2025, the popular Peer-to-Peer (P2P) Collect Request feature will no longer be available on payment apps like PhonePe, Google Pay, and Paytm.

This feature, which allows users to send payment requests to other UPI users, has been frequently exploited by fraudsters posing as friends, officials, or service providers.

Once an unsuspecting user accepts a fraudulent request, funds are instantly transferred from their account, leading to financial loss.

Although the transaction limit for P2P requests was set at ₹2,000, scammers continued to find ways to exploit it.

NPCI believes removing this feature will greatly reduce such risks.

From the given date, users will only be able to send money using methods like scanning a QR code or selecting a contact and confirming with their UPI PIN.

It’s important to note that this change will not affect merchant transactions with platforms like Amazon, Flipkart, Swiggy, or IRCTC.

These will still be able to send payment requests, but users must approve them with their UPI PIN.

This move is a step towards strengthening digital payment security and protecting users from fraudulent practices.