Learn about New Property Assessment System Introduced For Property, Vacant Land Tax – For mutations

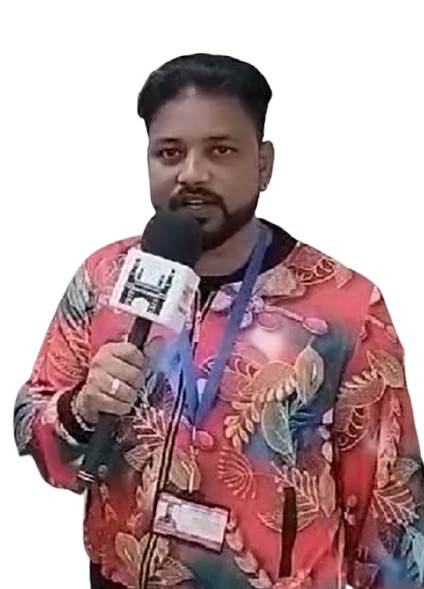

In a recent Press Meeting, GHMC addressed the problem of people struggling while getting their property assessments by introducing new online mutation and assessment system for properties

Addressing the meeting, GHMC opined that it observed the fact that the existing property tax system is not citizen-friendly for assessments. It;s even worse by the fact that the GHMC is currently short-staffed after the pandemic.

To combat this problem, the civic body has provided some relief to the public through a new system.

The following are the key alterations the mutation system which will come into force making way for easy tax assessments:

- On registration of any existing property which was already assessed to Property

Tax/Vacant Land Tax, the property is automatically mutated in the name of the new

owner without changing the existing PTIN/VLTN and Tax amount. - If the Registered property is new or not assessed to Property Tax or Vacant Land

Tax, a new PTIN/VLTN is generated and sent to GHMC online. - On receipt of PTIN/VLTN with property details from Registration Department,

Based, GHMC is generating Property Tax to residential properties with a Monthly

Rental Value of Rs 1.25 per sft for Jubille Hills Circle and Rs 1.00 per sft for Other

Circles. - In case of Vacant Land, the Vacant Land Tax is generated online @ 0.50% of

Registration Value. - On assessment of their Property to Property Tax/Vacant Land Tax, Citizen will

receive SMS with two links one to download the Assessment Copy and another for

Payment of property tax. - The New System will ensure that all the properties registered are assessment to

property/Vacant Land tax instantly without any human intervention. - There will be no Pendency of Assessments in GHMC Offices.

- Eliminate the discretion and encourage citizens to pay Taxes promptly.

Follow Us On Twitter @hydnewstoday