The likelihood of a U.S. recession in 2024-2025 is increasingly debated, with various factors shaping predictions:

Goldman Sachs has lowered its recession probability to just 15%, citing the U.S. economy’s resilience. This is in stark contrast to earlier, more

pessimistic outlooks .

Bank of America and J.P. Morgan provide higher estimates, predicting a 35-40% chance of a recession by the end of 2024, with a similar risk extending into 2025 .

The Federal Reserve staff is particularly optimistic, having recently removed their forecast of a 2024 recession altogether . Yet, key models like the yield curve inversion still show a 61% chance of recession in the next 12 months, an indicator that has historically been accurate .

Key Economic Signals:

The U.S. economy showed surprising strength in 2023, with robust consumer spending, job creation, and corporate profits. However, rising interest rates, slowing job growth, and increasing household debt are now placing more strain on the economy. Household debt in particular has surged, weakening consumer balance sheets, which are typically a critical driver of

U.S. economic growth :

The Federal Reserve’s tightening monetary policy, with higher interest rates aimed at combating inflation, is a key factor. Higher borrowing costs are impacting businesses, housing markets, and consumers, leading to slower economic activity .

Global Factors:

International pressures, such as China’s economic slowdown and weak activity in parts of Europe, are creating additional headwinds for the global economy. These factors can spill over into the U.S., especially in sectors reliant on global trade .

Positive Developments:

Despite these risks, the soft landing scenario—where inflation is controlled without causing a recession—is still possible. Inflation has been gradually decreasing, and some analysts expect the Federal Reserve to pause rate hikes. Furthermore, certain sectors, such as tech and industrials, have remained strong .

While recession risks have increased for 2024-2025, the outcome remains uncertain. The U.S. economy is experiencing mixed signals, with strong fundamentals in some areas offset by rising debt, slower growth, and external pressures. As a result, experts are divided, with estimates ranging from as low as 15% to as high as 61% depending on the economic model or institution.

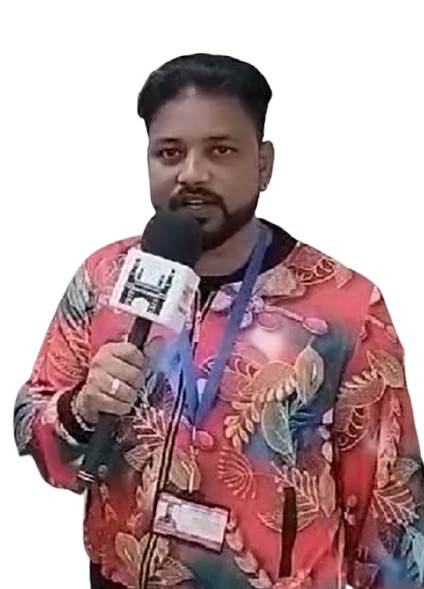

Ganesh is a versatile and skilled reporter with the rare ability to cover a broad range of subjects and write about them in an interesting and educational way, without being constrained to a particular subject area, including business, science, and technology, as well as everything in between.